when will capital gains tax increase take effect

Capital gains taxes for those currently paying 5 in this instance those in the 10 and 15 income tax brackets are scheduled for elimination in 2008. Applies resident and non-resident capital gains tax rates and allowances in 2022 to produce a capital gains tax calculation you can print or email.

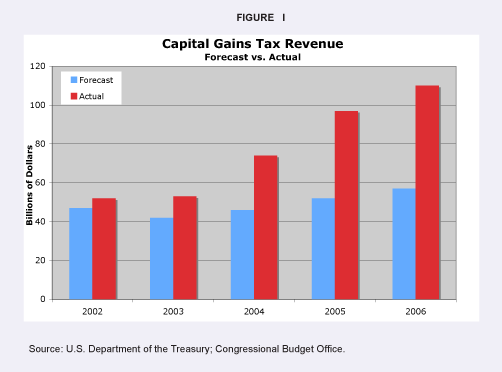

Some Effects Of The 2003 Capital Gains Tax Rate Cut

The capital gains tax came into effect on 1 January 2015 with 5 as the general applicable tax rate.

. Individual Income Tax Return. Douglas County Superior Court Judge Brian Huber ruled March 1 that the the capital gains. 1099-C Cancellation of Debt.

To round drop amounts under 50 cents and increase amounts from 50 to 99 cents. 1099-A Acquisition or Abandonment of Secured Property. This section summarizes important tax changes that took effect in 2021.

You must round all amounts. The first and easiest way to lower your capital gains burden is to take advantage of the capital gains tax exemption. It works the same as with property.

Supply and demand The supply and. Capital gains tax rates are the same. Was extended through 2010 as a result of the Tax Increase.

As a married couple filing jointly they were able to exclude 500000 of the capital gains leaving 200000 subject to capital gains tax. The Center Square The Citizen Action Defense Fund a local government watchdog nonprofit sent the Washington state Department of Revenue a letter demanding the agency stop its rulemaking activities related to implementing the capital gains income tax. For capital gains placed in Opportunity Funds for at least 5 years investors basis on the original investment increases by 10 percent.

This doesnt make sense to me. So 50 of 435k 2175k 33 71775 in taxes. If the other income is capital gains taxed at 0 then that would make your marginal tax rate 5 then 85 then 13 but the 13 85 of 15 rate would apply until you hit the 25 bracket at which point youd also hit the.

Services and capital between countries is a major effect of contemporary globalization. The tax is normally set by the government to correct an undesirable or inefficient market outcome a market failure and does so by being set equal to the external marginal cost of the. Ordering tax forms instructions and publications.

Individual Income Tax Return. If the above is correct you only pay capital gains on 50 of that and at the tax bracket applicable to your total income for the year. Than the standard capital gains tax.

Capital gains tax also comes into effect when you sell shares. Basis step-up of previously earned capital gains invested. A Pigovian tax also spelled Pigouvian tax is a tax on any market activity that generates negative externalities ie external costs incurred by the producer that are not included in the market price.

Long-term gains from investments held for more than a year receive a more favorable tax rate of either 0 individuals earning up to 40400 15 individuals earning up to 445850 or 20 individuals earning more than 445850 as of tax year 2021. Schedule D Form 1040 Capital Gains and Losses. An unrealized gain is a potential profit that exists on paperan increase in the value of an asset or investment you own but havent yet sold for cash.

A capital gains tax is a type of tax levied on capital gains profits an investor realizes when he sells a capital asset for a price that is higher than the purchase price. As of 1 January 2018 the new corporate income tax act is applicable according to which the companys profit is taxable at a rate of 20 only upon the distribution of profits. In some traditional definitions a tax haven also offers financial secrecy.

However capital gains taxes remain at the regular income tax rate for property held less than one year. In addition the capital gains tax decreased from rates of 8 10 and 20 to 5 and 15. On the other hand if the current fair market value of the property amounts to Php 2800000 and not Php 2400000 then the total capital gains.

Allows you to increase the cost base by factoring in changes to the consumer price index based on an asset acquired before 1145am. Not that filing a gift tax form is onerous but many people avoid it if they can. A tax haven is a jurisdiction with very low effective rates of taxation for foreign investors headline rates may be higher.

It is the mechanism for recovering your cost in an income-producing property and must be taken over the expected life of the property. These capital gains bracket thresholds increase to 80800 and 501600 for married couples. Tax cuts allow consumers to increase their spending which boosts aggregate demand.

The main difference between the capital gains tax and the plusvalia tax is that the capital gains tax is fairer to the seller because it is based on the proceeds realized from the transaction of the property or asset. Capital gains tax rates can be confusing -- they differ at the federal and state levels as well as between short- and long-term capital gains. Theres a 50 discount if you owned the shares for more than 12 months before disposing of them.

The gain is not realized until the asset is sold. Elements that effect Capital Gain complete all relevent. The Capital Gains Tax Exemption.

If youre selling a property for a total of Php 2400000 then the capital gains tax computation will amount to Php 144000. The net effect of that additional tax means that anyone in the 20 capital gains bracket actually pays 238 in taxes on that. Labor economics Labor.

This is great news if your house hasnt appreciated more than. This applies to earned income such as wages and tips as well as unearned income such as interest dividends capital gains pensions rents and royalties. Those existing capital gains are not taxed until the end of 2026 or when the asset is disposed of.

Depreciation is a capital expense. A measure of gains from trade is the increased income levels that trade may facilitate. This election in most cases wont increase the total tax owed on the joint return but it does give each of you credit for social security earnings on which retirement.

For singles the current exemption is 250000. In 2023 this gift tax exclusion amount will likely increase from 16000 to 17000. Capital gain is an increase in the value of a capital asset investment or real estate that gives it a higher worth than the purchase price.

Heres a sample computation of capital gains tax on sale of property. When additional income starts making Social Security income taxable its at 50 for a while then 85. Capital Gains Tax.

That means that the tax wont apply to the first 250000 of your capital gains. However while countries with high levels of secrecy but also high rates of taxation most notably the United States and Germany in the Financial Secrecy Index FSI rankings can be. Their combined income places them in the 20 tax bracket.

More long-term capital gains may push your long-term capital gains into a higher tax bracket 0 15 or 20 but they will not affect your ordinary income tax bracket. If the president really supports an increase in. On the other hand plusvalia tax does not.

Biden S Capital Gains Tax Hike What It Means For Your Taxes Cnet

The Bush Capital Gains Tax Cut After Four Years More Growth More Investment More Revenues

Effects Of Changing Tax Policy On Commercial Real Estate

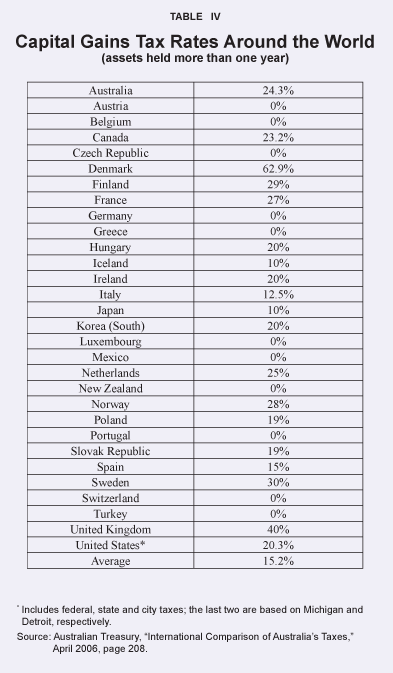

Brief Support Fair And Simple Capital Gains Taxes

What You Need To Know About Capital Gains Tax

Capital Gains Tax In The United States Wikipedia

Capital Gains And Why They Matter A Tax Expert Explains Synovus

Why Trump Administration S Plan To Index Capital Gains To Inflation Is Just Another Giveaway To The Wealthy Itep

It S Time To Close Hawaii S Capital Gains Tax Loophole Hawaiʻi Tax Fairness Coalition

2022 Capital Gains Tax Rates Smartasset

Capital Gains Tax On Real Estate And Home Sales

The Real Question On A Capital Gains Hike Is Whether It S Retroactive

Potential Changes To The Capital Gains Tax Rate Publications Foley Lardner Llp

Capital Gains Explained Finra Org

Biden Wants To Nearly Double Capital Gains Tax Here S What That Means

Capital Gains Tax Hike And More May Come Just After Labor Day

A Programmer Tries To Figure Out How Capital Gains Tax Actually Works By Fpgaminer Hackernoon Com Medium

/TPCGraph-237c1cdd9e03458c80dcc9439f37c51d.png)